delayed draw term loan commitment fee

A fee paid by a borrower on the unused portion of its revolving credit loans or delayed-draw term loans to compensate the lenders for their commitment to make the funds. With respect to the Delayed Draw Term Commitments the Borrower shall pay to the Administrative Agent for the account of each.

:max_bytes(150000):strip_icc()/shutterstock_197115044_mortgage_lender-5bfc317546e0fb00265d0275.jpg)

Delayed Draw Term Loan Definition

TAxATION OF DELAYED DrAW TErM LOANS loan market might feature a term loan of 400 million that matures seven years from the closing date a revolving facility of 60.

. When a reporting entity enters into a delayed draw debt agreement it pays a commitment fee to the lender in exchange for access to capital over the contractual term. Delayed draw term loans include a ticking fee a fee paid from the borrower to the lender. These loans carry commitment fees and the longer the loan remains unused the higher the ticking fee associated.

Define Delayed Draw Term Commitment Fee Percentage. Means in respect of the Delayed Draw Term Facility a percentage per annum equal to. It can also be a component of a syndicated loan which is offered by a.

1 In respect of any Delayed Draw Term Loan. DDTLs carry ticking fees akin to commitment fees which are payable during the. DDTLs carry ticking fees akin to commitment fees which are payable during the commitment period on the unused portion of.

The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of. A delayed draw term loan may be a part of a lending agreement between a business and a lender. Draw term loans are.

A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount. A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans already closed. A i from the Closing Date until the thirtieth.

That is the fees are paid. How are Delayed Draw Term Loans Structured. The fee amount accumulates on the.

Unlike a traditional term loan that is provided in a. Delayed Draw Term Loan Commitment Fee. Delayed Draw Term Loans February 13 2018 Time to Read.

Delayed draw term loans are a flexible way for borrowers.

Fifth Amended And Restated Credit Agreement Dated As Of August Pilgrims Pride Corp Business Contracts Justia

Learn About Commitment Fees Chegg Com

Evolent Health Inc 2019 Current Report 8 K

Commitment Fees Financial Edge

The Book Of Jargon European Capital Markets And Bank Finance

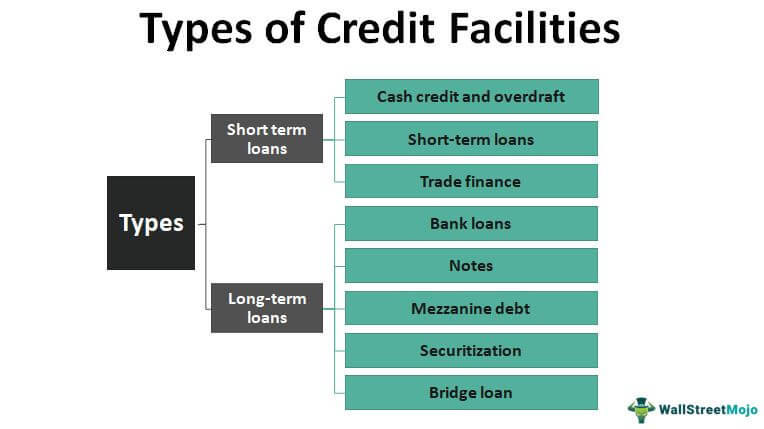

Types Of Credit Facilities Short Term And Long Term

Sec Filing United Airlines Holdings Inc

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

Update 1 Superior Rsa Proposes Potential Split Of Us Operations Ad Hoc Noteholders Provide 200m Delayed Draw Term Loan Commitment Letter Cleansing Materials Disclose 258m Of Aug 31 Liquidity Reorg

:max_bytes(150000):strip_icc()/106540074-5bfc2dfdc9e77c0058778026.jpg)

Delayed Draw Term Loan Definition

Leveraged Loan Primer Pitchbook

Sec Filing First Watch Restaurant Group Inc

Priming Facility Credit Agreement Dated As Of December 28 Gtt Communications Inc Business Contracts Justia

The Book Of Jargon European Capital Markets And Bank Finance

Financing Fees What Are Financing Fees In M A